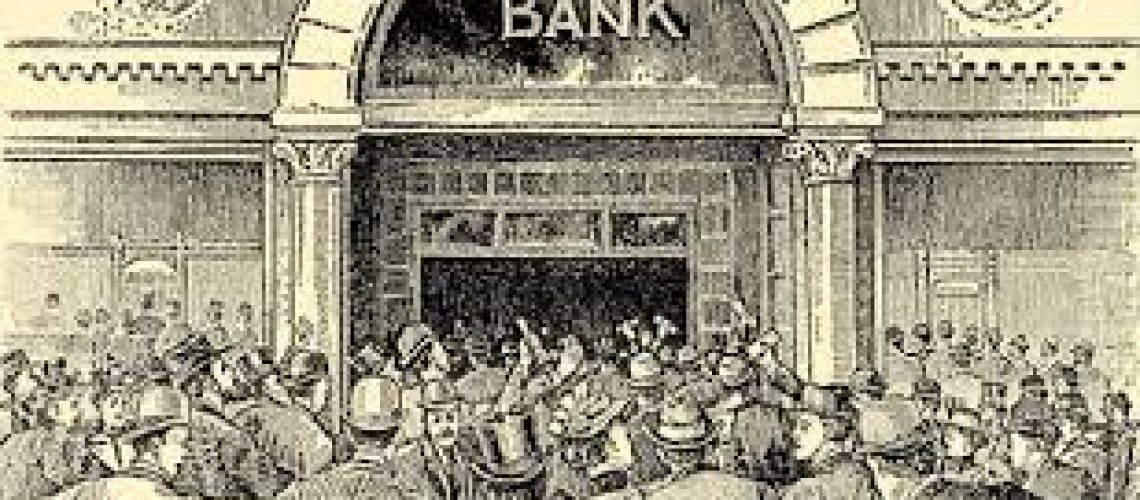

The Sixteenth Largest US Bank Failed Last Week Together with Yet Another Crypto-Linked institution.

Markets sold off last week. Two factors were at work. First, employment figures were stronger than expected, feeding into the bearish argument that interest rates must move higher to slow excess demand and inflation. And second, a regional bank with $200 billion in assets failed. While it may not be obvious, I think these events are connected.

My focus is on the consumer, whose spending drives the economy. But sometimes the credit cycle drives the consumer. Normally, the most important factor for consumer spending is employment. When U.S. consumers have jobs, they spend. The level of spending is influenced by many factors but the propensity to spend is so strong that consumers will even rush to make up on lost spending following periods of hesitation. I would not bet against the U.S. consumer.

That said, consumers need access to credit (loans from banks) for important transactions like homes and autos. Businesses need access to capital to make investments and hire more workers. During periods of external shock, such as during the Covid panic or in the wake of the 2007-2009 financial crisis, banks reacted to uncertainty by pulling back on lending. The below chart clearly shows caution around lending during those events and also, of more concern, today.

Ultimately, the Fed stepped in during the financial crisis to support banks and get lending going again. This was considered a success. The Fed and the administration were following the same playbook during the Covid panic, but unfortunately overdid it. Ultra-low interest rates, direct payments to individuals, the suspension of loan and other payments, and other bank actions flooded the system and created excess demand. One result has been higher prices for food and services (inflation). Another result was distortion in financial markets. Flourishing crypto fraud, meme-stock mania, and crazy valuations for unprofitable tech stocks were all spawned in the toxic cocktail of stimulus checks, greed, and the lack of risk aversion that comes with free money.

Crypto-banks should fail and meme stock investors need to be zeroed out, unfortunately. The Fed’s year-long campaign to raise interest rates is directly intended to put an end to the excesses that are behind rising prices for goods and services. Lower stock market, home and other asset prices are a part of this plan. There is no debate about whether the Fed will win in its effort to destroy excess demand. The debate is whether the Fed can achieve this result without throwing the economy into a deep recession. On the one side are the optimistic “soft-landers”. The soft-landers look at current consumer and economic activity as a sign that the economy will keep going even with the impact of higher rates. Meanwhile, the skeptics fill up my LinkedIn feed with posts written in all caps and warning that Powell’s efforts are yet to be fully seen will “break something”. I call the bearish camp the “apocalyptic chartists” for their propensity to post scary charts (like the above).

Is the failure of Silicon Valley Bank tangible evidence of a broader, more systemic problem stemming from rising interest rates? Will its failure wreck confidence among investors in other banks, or cause banks to reduce risk by cutting lending to consumers and businesses? I’m not a bank analyst or expert but this event certainly does not seem positive for lending.

Here’s my guess: If efforts over the weekend to purchase all or part of Silicon Valley Bank are successful and the majority of depositors are made fully or mostly whole, then crisis will be averted. Calm may be restored. Nevertheless, risks to the system from the efforts to slow the economy and fight inflation have become more apparent. Expect the apocalyptic chartists to get louder.

Feedback and commentary welcome. Would you like to learn more about how we invest in the markets? Please click here to get in touch.

John Zolidis

President & Founder

Quo Vadis Capital, Inc.

John.zolidis@quovadiscapital.com

Mr. Zolidis founded Quo Vadis Capital, Inc., a Registered Investment Advisor (RIA) and research consultancy, in 2017. He started his career in finance in 1996 following degree studies in Philosophy at Kenyon College and the University of Oxford. He has followed U.S. consumer companies as a senior analyst since 1999, mostly on the sell-side, writing research for institutional investor clients. He also managed money in a buy-side role at a long-short equity fund over 2013-2014. He was named in the Wall Street Journal’s Best on the Street list in 2005. Mr. Zolidis and works from New York, NY and Paris, France or wherever he has his laptop.

Travel update: Heading Austin & Houston at the close of March and early April. I concluded last month’s travels with a guest lecture at Columbia Business School. The topic was how to know when to sell a security. I recorded a condensed (12 minute) version, which I uploaded to youtube. Email me if you’d like the full slide deck. At the end of this month, I will fly to Texas to visit my brother, a playwright living in Austin and my nephews. My excuse is two days of analyst meetings and presentations with Academy Sports + Outdoors (ASO), a sporting goods retailer that I follow and write about for my professional investor clients.

General Disclosures:

Quo Vadis Capital, Inc. (“Quo Vadis”) is an independent research provider offering research and consulting services. The research products are for institutional investors only. THIS IS NOT AN ADVERTISEMENT. Please consult your financial advisor for advice tailored to your financial and risk profile.

The price target, if any, contained in this report represents the analyst’s application of a formula to certain metrics derived from actual and estimated future performance of the company. Analysts may use various formulas tailored to the facts and circumstances surrounding a specific company to arrive at the price target. Various risk factors may impede the company’s securities from achieving the analyst’s price target, such as an unfavorable macroeconomic environment, a failure of the company to perform as expected, the departure of key personnel or other events or circumstances that cannot be reasonably anticipated at the time the price target is calculated. Quo Vadis may change the price target on this company without notice. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources Quo Vadis believes to be reliable; however, Quo Vadis does not guarantee its accuracy and does not purport to be complete. Opinion is as of the date of the report unless labeled otherwise and is subject to change without notice. Updates may be provided based on developments and events and as otherwise appropriate. Updates may be restricted based on regulatory requirements or other considerations. Consequently, there should be no assumption that updates will be made. Quo Vadis disclaims any warranty of any kind, whether express or implied, as to any matter whatsoever relating to this research report and any analysis, discussion or trade ideas contained herein. This research report is provided on an “as is” basis for use at your own risk, and neither Quo Vadis nor its affiliates are liable for any damages or injury resulting from use of this information. This report should not be construed as advice designed to meet the particular investment needs of any investor or as an offer or solicitation to buy or sell the securities or financial instruments mentioned herein. This report is provided for information purposes only and does not represent an offer or solicitation in any jurisdiction where such offer would be prohibited. Commentary regarding the future direction of financial markets is illustrative and is not intended to predict actual results, which may differ substantially from the opinions expressed herein. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. The author of this write up does not have any positions in securities mentioned.

Permission is hereby granted to reproduce or redistribute this report. Please cite Quo Vadis Capital, Inc. in any reproduction.

SEC Reg AC Certification: All of the views expressed in this research report accurately reflect the research analyst’s personal views about any and all of the subject securities or issuers. No part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in the subject company of this research report.