This weekend we were shocked to read that more than 2,300 cans of Miller High Life were destroyed on the orders of French customs authorities. The offense? Illicitly calling itself The ‘Champagne’ of Beers.

Agents in Belgium (a nation that respects beer unlike its neighbors to the south…) who were charged with intercepting the shipment, supplied a sad photo of the crushed cans. My Wisconsinite roots suspect another story, rather than the guillotine, the High Lifes probably finished in the Belgian gullet.

The stock market has also avoided the guillotine thus far in 2023. The S&P 500 is up about 8%. This has happened amidst a chorus of bearish prognostications. Big tech stocks have rebounded, and the consumer continues to spend. As we have pointed in previous letters, consumer spending is 2/3 of the U.S. economy. Consumers spend when they’re employed. Perhaps the job market is softening but unemployment remains near 50-year lows and there are still nearly two available jobs for every unemployed person. Conditions are hardly terrible

Nevertheless, investing is about the future and today’s job market and economic conditions only provide a starting point for guessing where we will be a year from now. The bearish argument holds that we haven’t yet really seen the impact of Fed’s campaign to raise interest rates and reverse the over-stimulated conditions that propelled stock market gains in 2020 and 2021. The 2022 market rout was only the beginning, according to pessimists. Last month’s bank failures are another bad sign and foreshadow tighter lending standards for consumers and businesses. According to the bears, the YTD gains in stock prices reflect investor complacency and a lack of understanding of how similar conditions in the past have played out. On the other side of the debate, there are the soft-landers who think the economy will slow and inflation will diminish in a nice even fashion. Then there is the strange (to my mind) supposedly bullish argument that things will quickly get so bad that the Federal Reserve will have to start cutting interest rates again, maybe even before the end of 2023.

There are three problems with the debate about where we’re heading, in my opinion. First, the reality is that neither bears nor bulls know what’s going to happen. In my experience, there has always been someone arguing for the apocalypse in literally every market environment I’ve seen. If the market has been rising, the naysayers argue that the good times can’t last and stocks are too expensive. If there are problems, pessimists think the current troubles are intractable, planes will fall out of the sky, flowers will stop growing and we’ll all soon be scratching around in the woods for bits of gold to use in a barter system. On the other hand, the permabulls are also guilty of intellectual dishonesty and survivorship bias by generally pointing only to the performance of the U.S. stock market when they repeat the axiom stocks always go up over the long-term. The bottom-line is that future performance of the market depends on things we don’t know and things we don’t know that we don’t know. If you think you can tell others what will happen in the markets and are compelled to write in all caps to shout it to the world, you’re likely only fooling yourself.

The second problem with the debate is that the stock market is not the economy. It is possible (theoretically) to be 100% correct in your forecast about the economy and still be completely wrong (non-theoretically) about what stock prices will do. We’ve pointed out in previous letters that markets historically reached short-term bottoms at the start or before the start of recessions. In fact, during the past 10 recessions, the average change in the markets is a decline of only 2.2%. This should tell you that during recessions stocks sometimes went up. There’s a good explanation for this but the point is that it’s not easy to take perfect foresight about the economy (if such a thing were possible, which it isn’t) and translate it into excellent investment decisions to buy or sell securities.

Lastly, a third problem about this debate, which is a new point I want to articulate today is this: the length of the economic cycle is misaligned with your investment time horizon. Let’s say your investment objective is to cover the cost of university, accumulate a down payment for a house, fund your retirement, or to build wealth you intend to give away. All these involve periods that last much longer than the average recession (only 10 months, on average since WWII) or economic expansion (almost five years, on average, since WWII). Accordingly, a successful investment strategy should be detached from the economic cycle. If this is true, why are so many people in finance and the financial media so intently focused on predicting near-term GPD growth rates or the direction of interest rates? It comes back to incentives. Professional investors are measuring their performance in one-year increments arbitrarily set to the calendar year. Salespeople need financial products to sell, and they find it useful to use annual performance in their pitches and literature. The media is even more short-term oriented, they need you to come back literally every day for more news.

Repeat after me: The apocalyptic chartists can’t predict the future, the market is not the economy, my time horizon is much longer than the economic cycle and Wall Street is playing a different game, one I don’t want to play.

Selection From our Investment Portfolio: Yeti, Holdings Inc. (YETI)*

All that said, there is an economic cycle and what strategy should you use to invest throughout it? My approach is remain fully invested and to focus on owning in wonderful companies that can grow. The easiest part of this approach is identifying which companies are wonderful today. Determining which companies will still be wonderful many years into the future is hard but possible. The really difficult part is trying to adhere to a discipline where you only buy the stocks of these wonderful companies at prices below what their rosy futures justify. One situation I have looked for historically has been companies that are going through a short-term challenge and where Wall Street appears to be pricing the stock as if the challenge is permanent.

An example, in my view, is Yeti Holdings, Inc. (YETI) which I recently added to client portfolios. If you’re not familiar with YETI (and this is more likely to be the case if you live outside the U.S.) the company is a branded maker of high-end coolers and insulated drinkware. It’s an innovative company that has redefined how consumers think about and what they’ll spend for high-performance, outdoor gear to accompany activities like camping, fishing and hunting but also to keep drinks cool for the backyard BBQ or on the sidelines of the kids’ soccer games. The brand has become something of a status symbol and, in my experience, the product is superior and justifies the premium price charged.

YETI came public in 2018 at $16 per share and was doing just fine. Then the pandemic came along and supercharged its growth. Over a two-year period, earnings expectations for YETI more than doubled. The stock shot up, topping out above $100 around the market peak in late 2021. At that price, the company was valued over $9B and was trading at a multiple of roughly 36x its future earnings per share. This is not what I would describe as “cheap.”

Three factors served to knock YETI off this perch and create the opportunity I see now. Revenue growth slowed in 2022 vs. the torrid stimulus-driven pace of 2020 and 2021. Margins compressed, partially due to higher shipping container costs which have now eased. Then there was a product recall, announced in January 2023. YETI became aware that small magnets in some of the closures inside certain coolers could become detached and potentially be ingested (if they were to become mixed with drinks and ice, for example), presenting a health hazard. Importantly, no one reported being harmed. The company nevertheless felt the prudent step was to recall about two million units and pull products from the shelves. The result of the product recall, besides a large write-off taken in 2022, will be slower growth over the first three quarters of 2023. This is the challenge.

The net impact of the factors discussed above is a decline in the stock price to $39, representing a market value of $3.4B and a P/E of only 14x estimated 2024 earnings. This price is interesting, in my opinion. But what about any impact to the brand from the recalls? And how can YETI grow from here? Aren’t coolers and insulated drinkware small categories? Is this even a “wonderful” company?

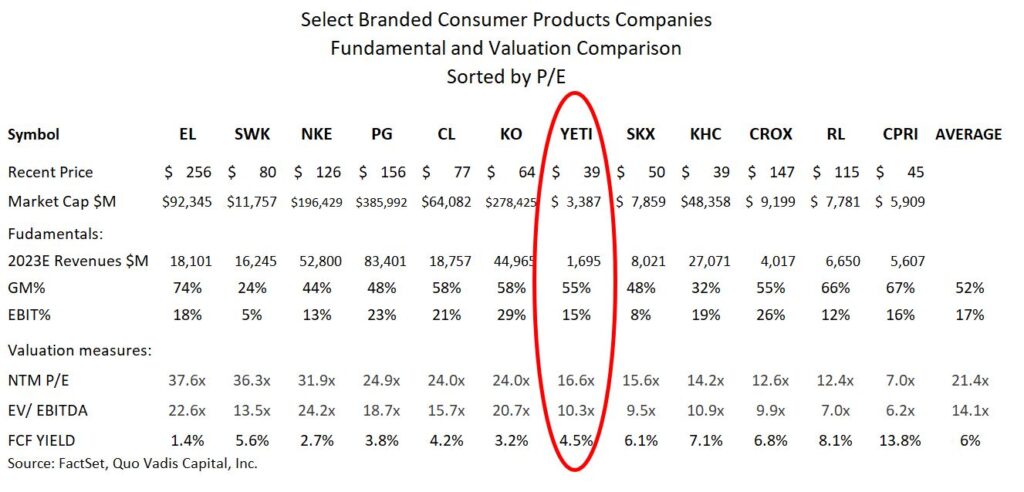

The longer-term investment case is that YETI is a strong brand and can expand into adjacent categories and grow and that it is early in its growth curve. To evaluate the strength of the brand, I compared YETI’s margin structure to that of a selection of other branded consumer product companies. (See figure below.) I also conducted my own research and the feedback is that the product recall has not dented demand. Lastly, YETI recently launched plastic water bottles, called the Yonder, to its product assortment and I believe there are many additional categories into which the brand can extend with authenticity. I expect growth to accelerate into the end of 2023 and 2024 with investors paying a higher multiple to earnings for the shares. My stash of the Champagne of Beers will stay nice and cold.

*This is not a recommendation to buy or sell any security. Please consult with your investment advisor for advice tailored to your investment objectives and risk tolerance.

Feedback and commentary welcome. Would you like to learn more about how we invest in the markets? Please click here to get in touch.

John Zolidis

President & Founder

Quo Vadis Capital, Inc.

John.zolidis@quovadiscapital.com

Mr. Zolidis founded Quo Vadis Capital, Inc., a Registered Investment Advisor (RIA) and research consultancy, in 2017. He started his career in finance in 1996 following degree studies in Philosophy at Kenyon College and the University of Oxford. He has followed U.S. consumer companies as a senior analyst since 1999, mostly on the sell-side, writing research for institutional investor clients. He also managed money in a buy-side role at a long-short equity fund over 2013-2014. He was named in the Wall Street Journal’s Best on the Street list in 2005. Mr. Zolidis and works from New York, NY and Paris, France or wherever he has his laptop.

Travel update: Going to Barcelona in May. Earlier in April I went to Texas to attend the Academy Sports + Outdoors (ASO) analyst day in Houston. To kick off my trip I started in Austin where I visited my brother and my two nephews. We enjoyed a day of guided fly fishing on the Llano river which was great fun. Of course, no trip to Texas is complete without BBQ. And Tacos. In May I am taking the train to Barcelona to attend ShopTalk Europe, a retail industry conference that brings together executives and others from retailers, tech companies, suppliers and consumer products business. No fishing is planned but I am looking forward to chowing down on some patatas bravas.

General Disclosures:

Quo Vadis Capital, Inc. (“Quo Vadis”) is an independent research provider offering research and consulting services. The research products are for institutional investors only. THIS IS NOT AN ADVERTISEMENT. Please consult your financial advisor for advice tailored to your financial and risk profile.

The author of this letter and accounts managed by Quo Vadis Capital have a long position in shares of Yeti Holdings, Inc. (YETI).

The price target, if any, contained in this report represents the analyst’s application of a formula to certain metrics derived from actual and estimated future performance of the company. Analysts may use various formulas tailored to the facts and circumstances surrounding a specific company to arrive at the price target. Various risk factors may impede the company’s securities from achieving the analyst’s price target, such as an unfavorable macroeconomic environment, a failure of the company to perform as expected, the departure of key personnel or other events or circumstances that cannot be reasonably anticipated at the time the price target is calculated. Quo Vadis may change the price target on this company without notice. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources Quo Vadis believes to be reliable; however, Quo Vadis does not guarantee its accuracy and does not purport to be complete. Opinion is as of the date of the report unless labeled otherwise and is subject to change without notice. Updates may be provided based on developments and events and as otherwise appropriate. Updates may be restricted based on regulatory requirements or other considerations. Consequently, there should be no assumption that updates will be made. Quo Vadis disclaims any warranty of any kind, whether express or implied, as to any matter whatsoever relating to this research report and any analysis, discussion or trade ideas contained herein. This research report is provided on an “as is” basis for use at your own risk, and neither Quo Vadis nor its affiliates are liable for any damages or injury resulting from use of this information. This report should not be construed as advice designed to meet the particular investment needs of any investor or as an offer or solicitation to buy or sell the securities or financial instruments mentioned herein. This report is provided for information purposes only and does not represent an offer or solicitation in any jurisdiction where such offer would be prohibited. Commentary regarding the future direction of financial markets is illustrative and is not intended to predict actual results, which may differ substantially from the opinions expressed herein. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. The author of this write up does not have any positions in securities mentioned.

Permission is hereby granted to reproduce or redistribute this report. Please cite Quo Vadis Capital, Inc. in any reproduction.

SEC Reg AC Certification: All of the views expressed in this research report accurately reflect the research analyst’s personal views about any and all of the subject securities or issuers. No part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in the subject company of this research report.