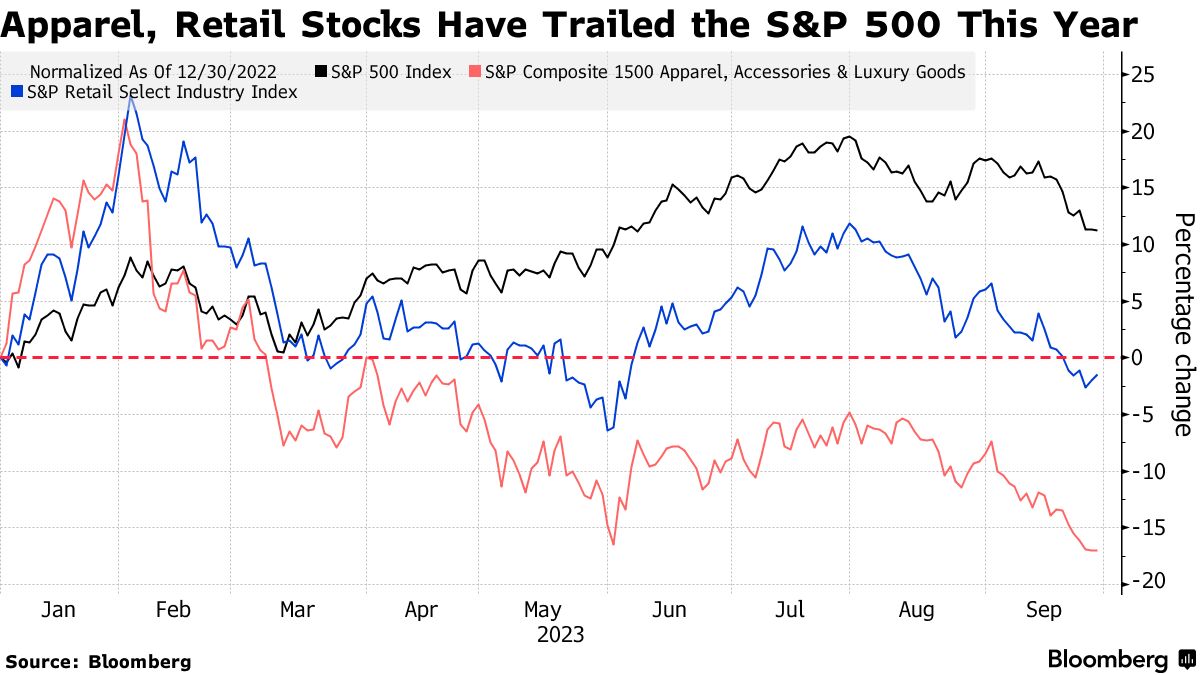

- Apparel, retail stocks lag market with borrowing costs rising

- Investors focus on back-to-school demand, annual outlook

September 28, 2023 at 7:00 AM EDT

Nike Inc. is set to offer a crucial look at the financial health of American households as Wall Street frets over a growing list of headwinds to spending and consumer-linked stocks languish.

Apparel and retail shares are trailing the market by a wide margin in 2023 with rising borrowing costs and still-elevated inflation sapping demand for sneakers, clothes and other discretionary items. Now strategists including Morgan Stanley’s Michael Wilson are warning that risks are only rising for consumer stocks given higher gasoline prices and next month’s resumption of student-loan payments.

Against that backdrop, Nike’s earnings after the close Thursday are drawing extra attention, especially after government figures showed US consumer spending rose at the weakest pace in a year last quarter.

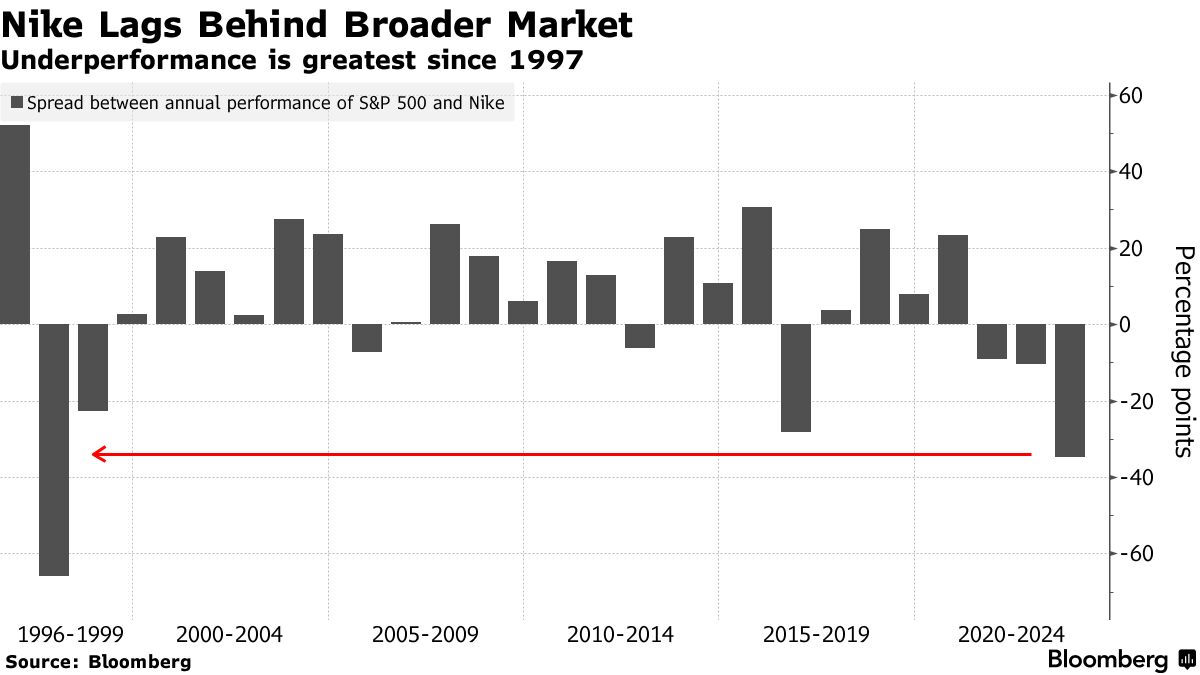

Shares of the world’s largest sportswear company are having their worst year since 1997 relative to the overall market, and investors will have in mind last month’s gloomy results from Nike retail partners Dick’s Sporting Goods Inc. and Foot Locker Inc. Nike shares were little changed in early trading Thursday after slumping for nine straight sessions.

“I think the guidance is going to be rather downbeat,” said Edward Moya, senior market analyst for the Americas at Oanda. “We’re going to get another wave of consumer softness concerns.”

Moya, however, says the worst is almost priced in for consumer stocks, given how badly they’ve fared.

Nike Signals

Nike’s results, which cover the three months through August, will help investors assess that outlook. The shares are on pace to slide a fourth straight week and are down more than 20% this year. Concern about the economy of China, a key Nike market, has contributed to the weakness.

Stacey Widlitz, president of SW Retail Advisors, will be watching for commentary around back-to-school shopping as Nike is the first notable apparel company to release results that include August.

At UBS Group AG, analyst Jay Sole doesn’t expect this report to revive the stock. He’s among analysts anticipating Nike will issue disappointing guidance for the current quarter. Others on Wall Street worry it will lower fiscal-year projections.

“The issue for the stock is many investors also have doubts about Nike’s long-term growth potential,” Sole wrote in a note to clients last week. Money managers also have questions around its approach to selling directly to consumers and why it has lost share in the running category, Sole said.

With student-loan payments about to kick in again, Jefferies Financial Group Inc. analysts led by Randal Konik downgraded recommendations on Nike, Foot Locker and Urban Outfitters Inc. to hold from buy.

Meanwhile, analysts at Bank of America Corp., Citigroup Inc. and Wells Fargo & Co. cut their 12-month price targets for Nike in recent weeks. And Wells Fargo’s Ike Boruchow said he expects “more bad than good news” from its earnings.

After the tough quarters from Nike’s retail partners, Widlitz at SW Retail also plans to monitor the extent of discounting on the firm’s merchandise.

“What helps Nike to be relevant more broadly is how many different consumer segments they touch,” said John Zolidis, founder of consumer-focused investment adviser Quo Vadis Capital. It’s not a high-end business and it’s not a low-end business, so “it’s a pretty good indicator of what’s happening out there.”