The market can keep rising until something changes

Why are prices for stocks rising? There are three main reasons that I can identify. The first is still simply expectations for falling interest rates. When does this get fully reflected in stocks? We may be there, but I would guess that momentum will carry stocks higher until we actually get the cuts.

The second factor is the consumer. Retailer and other results show that the consumer (whose spending is 2/3 of the U.S. economy) came through the 2023 Holiday shopping season in strong form. Fund managers who have underweight the consumer sector or were positioned defensively based on last year’s concerns have been forced to buy stocks. Third, I would cite the excitement around Artificial Intelligence (AI). AI is not new but large language models and the commercial application therefrom are recent developments. AI has moved from the theoretical to the commercial. The technology is way outside my area of expertise but I sense that it has “open-ended” implications. This puts it in a genre that could potentially cause investors to lose perspective and rationality. For the moment I see it as a positive for markets.

Last Month I Wrote that I had Sold Apple (AAPL) But Was Hanging on to Facebook (META)

On a very short-term basis, this has been the right call as AAPL is since down about three percent while META gained more than five percent. I outlined three criteria I use for selling a stock, 1) the company’s growth narrative is broken, 2) the price is ridiculous, and 3) I found something better to own. In AAPL’s case, I felt persistent weak revenue performance that I discussed was a challenge to the growth story and inconsistent with the shares’ premium valuation. I mused that AAPL shares were reflecting expectations for the company to enter (& dominate) another huge category such as automobiles. Well, the news came out during the month that Apple was abandoning its project to build cars. I have little doubt AAPL will find a way to reignite growth but in the meantime it feels like investors are paying for that growth without any visibility on what is going to create it.

This Brings Us to Costco (COST) and another Issue

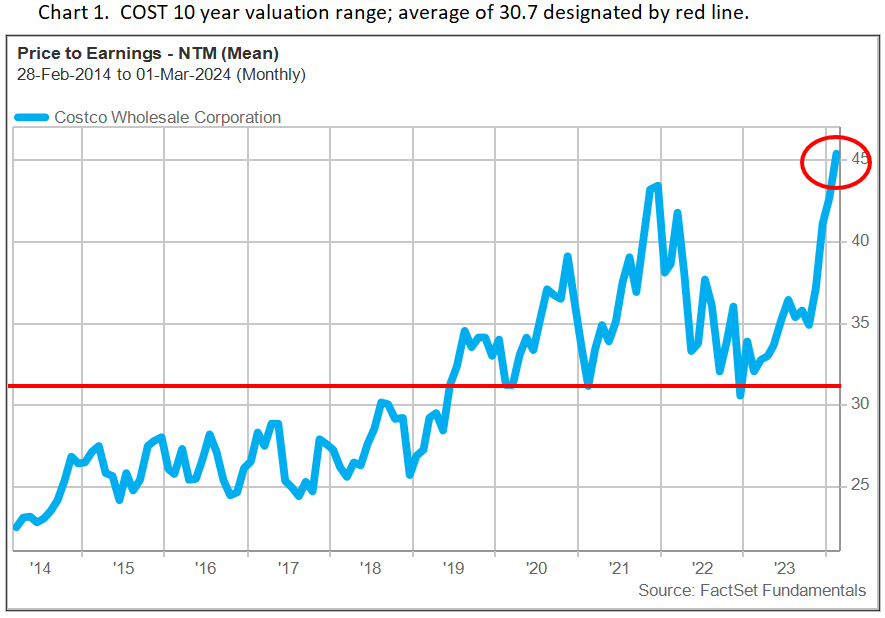

COST shares have been in our client portfolio for over five years. Leaving behind the megatech names, most people are familiar with Costco (COST), the largest club retailer. I think it’s universally agreed that COST is an excellent retail company. The stock has been a massive outperformer for decades. Zeroing in on just the past five years the shares are up more than 200% including gains of more than 50% in the last 12 months. What’s the problem? The stock has materially outpaced the company’s excellent fundamentals. For example, earnings per share over the past five years have (only) doubled. The result is that COST’s valuation has expanded to the absolute highest level in the company’s long renowned history as a public company.

As you can see in the 10-year valuation chart, COST’s price to earnings (P/E) has vaulted to the mid 40s. Prior to 2019 the shares mostly traded in the 20s. The COST story remains excellent but is it materially better than five or ten years ago? I don’t think so. Do lower interest rates matter here? Sort of but not really. Is this a secret AI play? If it is, I am not in on the secret. In my view the stock is up because the market is up, investors are chasing performance, and not because Costco’s fundamentals have changed in a meaningful way. Is the price “ridiculous”? Many retailer stocks at 52-week or all-time highs but COST stands out based on its absolute multiple and the extent that its valuation is extended relative to history. I am reducing exposure.

Upcoming activities

I am flying to New York on Monday, March 4th.

The purpose of my trip is to attend the Target (TGT) analyst day and meet with clients. On Tuesday I will also give a guest lecture at Columbia Business School. The topic is going to be avoiding errors in the investment decision making process. I’m going to approach this more from a psychological perspective rather than delve into errors of analysis. It’s going to be really fun! I’ll record a condensed version will advise when I have uploaded it to YouTube. I have two previous lectures already up on the site, one on idea generation and time management and the second on the selling discipline. I don’t get paid for the lectures, but I like having the chance to think about investing at a higher level and to talk to students. To finish my trip, I’ll spend some time in Southampton, NY before heading to New Orleans to visit my daughter Ophelie who is a junior at Tulane University. If you’ll be in NYC, Southampton or New Orleans and would like to meet up, please send me a message.

Feedback and commentary welcome. Would you like to learn more about how we invest in the markets? Please click here to get in touch.

John Zolidis

President & Founder

Quo Vadis Capital, Inc.

John.zolidis@quovadiscapital.com

Mr. Zolidis founded Quo Vadis Capital, Inc., a Registered Investment Advisor (RIA) and research consultancy, in 2017. He started his career in finance in 1996 following degree studies in Philosophy at Kenyon College and the University of Oxford. He has followed U.S. consumer companies as a senior analyst since 1999, mostly on the sell-side, writing research for institutional investor clients. He also managed money in a buy-side role at a long-short equity fund over 2013-2014. He was named in the Wall Street Journal’s Best on the Street list in 2005. Mr. Zolidis and works from New York, NY and Paris, France or wherever he has his laptop.

General Disclosures:

Quo Vadis Capital, Inc. (“Quo Vadis”) is a Registered Investment Advisor (RIA) in the State of New York. THIS IS NOT AN ADVERTISEMENT. Please consult your financial advisor for advice tailored to your financial and risk profile.

The author of this letter and accounts managed by Quo Vadis Capital have a long position in shares of META and COST.

The price target, if any, contained in this report represents the analyst’s application of a formula to certain metrics derived from actual and estimated future performance of the company. Analysts may use various formulas tailored to the facts and circumstances surrounding a specific company to arrive at the price target. Various risk factors may impede the company’s securities from achieving the analyst’s price target, such as an unfavorable macroeconomic environment, a failure of the company to perform as expected, the departure of key personnel or other events or circumstances that cannot be reasonably anticipated at the time the price target is calculated. Quo Vadis may change the price target on this company without notice. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources Quo Vadis believes to be reliable; however, Quo Vadis does not guarantee its accuracy and does not purport to be complete. Opinion is as of the date of the report unless labeled otherwise and is subject to change without notice. Updates may be provided based on developments and events and as otherwise appropriate. Updates may be restricted based on regulatory requirements or other considerations. Consequently, there should be no assumption that updates will be made. Quo Vadis disclaims any warranty of any kind, whether express or implied, as to any matter whatsoever relating to this research report and any analysis, discussion or trade ideas contained herein. This research report is provided on an “as is” basis for use at your own risk, and neither Quo Vadis nor its affiliates are liable for any damages or injury resulting from use of this information. This report should not be construed as advice designed to meet the particular investment needs of any investor or as an offer or solicitation to buy or sell the securities or financial instruments mentioned herein. This report is provided for information purposes only and does not represent an offer or solicitation in any jurisdiction where such offer would be prohibited. Commentary regarding the future direction of financial markets is illustrative and is not intended to predict actual results, which may differ substantially from the opinions expressed herein. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. The author of this write up does not have any positions in securities mentioned.

Permission is hereby granted to reproduce or redistribute this report. Please cite Quo Vadis Capital, Inc. in any reproduction.

SEC Reg AC Certification: All of the views expressed in this research report accurately reflect the research analyst’s personal views about any and all of the subject securities or issuers. No part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in the subject company of this research report.