Saving the Nation – June 2023 Investing Letter

The debt ceiling deal was the biggest non-surprise of 2023. So why did the market rally on its completion? The stock market (measured by the

The debt ceiling deal was the biggest non-surprise of 2023. So why did the market rally on its completion? The stock market (measured by the

John Zolidis, a veteran retail analyst and president of Quo Vadis Capital, told MarketWatch that retailers might want to limit their expectations, noting that with so many stores looking to fill the Bed Bath & Beyond void, the sales bump might be limited for each.

In effect, the bump “is going to be dispersed,” Zolidis said.

This weekend we were shocked to read that more than 2,300 cans of Miller High Life were destroyed on the orders of French customs authorities.

Will LULU maintain the growth rate and margins? Zolidis, who rates the company’s shares BUY, thinks so.

“The company has kept it going much longer than nearly all others,” he said. “Bottom-line, after two years of the stock moving sideways despite consistent upward revisions to earnings, last night’s results could be the event that sets off a round of valuation expansion and vaults the name firmly back into the momentum camp. Certainly, this profile is not for everyone but for those already involved, we feel that playing for additional gains is supported by the fundamentals and outlook.”

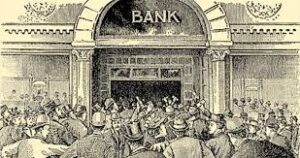

The Sixteenth Largest US Bank Failed Last Week Together with Yet Another Crypto-Linked institution. Markets sold off last week. Two factors were at work. First,

News reports claim that Canada and the U.S. have abandoned the search for downed floating objects. Apparently, the governments are comfortable that they may never have an

John Zolidis, founder and president of Quo Vadis Capital, said: “The question for shareholders is whether the company can scale to profitability and positive cash flow without needing an equity raise. It’s a steep hill to climb but could be possible depending on execution.”

Please click the link to view a short excerpt from our discussion on CNBC Asia Squawk Box regarding YUM China. We discuss the company’s execution and the valuation of the shares.

An article in today’s WSJ notes that nearly 2/3 of professional economists predict recession in 2023. This has basically never happened before.

“The retail management teams with whom we speak do not consider themselves to be economists,” Zolidis said. “They have little ability to forecast inflation beyond what is immediately apparent. They’re no better at predicting interest rates than anyone else.”